You’re running a business as well as a practice after all!

But regardless of your practice size or specialty, there are 3 numbers you should always know – or be able to know at a moment’s notice:

1. Aging Accounts Receivable

2. Write Offs

3. Denials

If you know these numbers, you have insight into the financial and administrative health of your practice. As well as some built-in metrics for staff performance.

Aging Accounts Receivables = Practice Health

Most of the time.

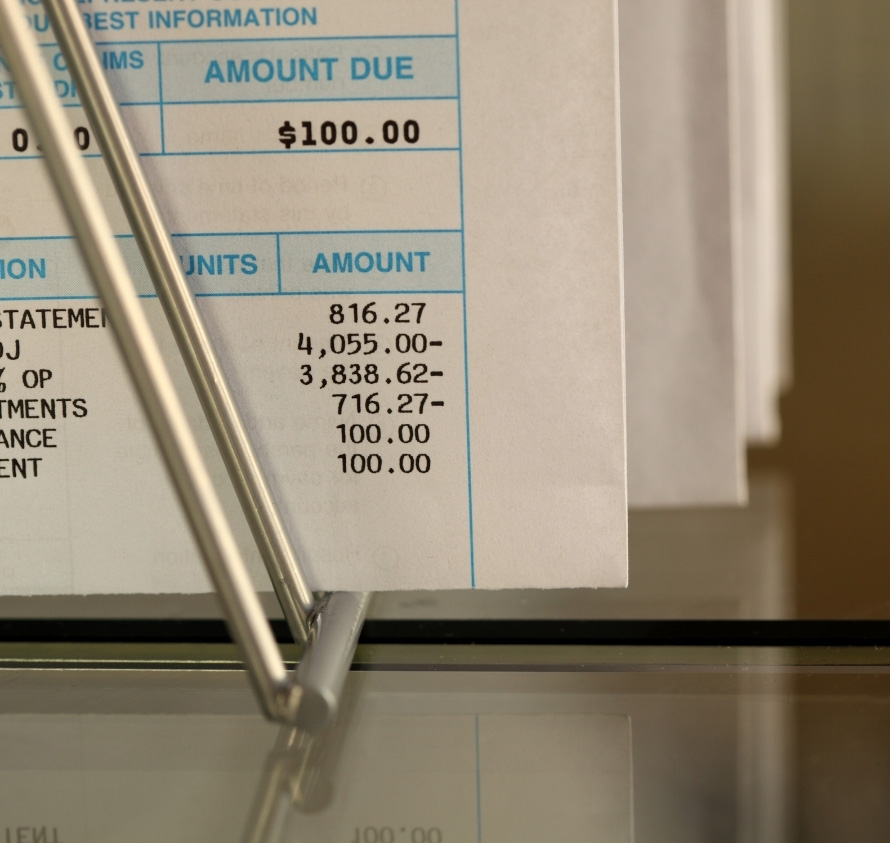

According to the Corporate Finance Institute, aging AR sorts the unpaid customers and credit memos by date ranges.

Claims due withing 30 days, past due 31 to 60 days, and past due 61 to 90 days are the most common. For your medical practice those outstanding claims will be to individuals directly, insurance payers and perhaps Medicare or Medicaid depending on your services.

An aging report from your accounting department, or if you use an outsourced medical billing and coding service like Integra, your partner, should be provided on a weekly basis.

That report will tell you how much money you have coming in in the next 30 days. AND who’s late in paying you what you’re owed.

If your average aging AR is under 30 days – something wrong. Unless people are prepaying in cash, that’s not a reasonable expectation.

If it’s 31-60 days, it provides your staff a healthy list of companies and people to work on paying you. This range is common for institutional payers like insurance companies. But you should start watching for Denials here.

When your average is over 60 days there is likely something wrong. Either in collections, medical billing and coding practices or internal office procedures and performance.

Writing Off Medical Bills and Claims

A “write off” happens when your collections team decides that there’s no possibility of collecting.

That can be a legitimate decision for many reasons, but it can also be a warning sign that something is wrong. Here are a few things that a higher number of write offs than usual may indicate:

Poorly educated medical billing staff

– it may be that coders/billers don’t know exactly when they should write off an claim

Manipulation of the numbers

– during one of our Free Medical Billing Audits we found one administrator, who was judged by the number of Denials (NOT write offs), that just wrote off any submittal over 45 days or so

Denials and follow ups

- Improper Medical Coding leads to denials. And if Denials aren’t responded to properly within a short period of time you will not be able to collect.

Denials | Billing and Coding Health Check

Staying on top of Denials is probably the best way to make sure that you’re getting paid, and paid properly, for the work you perform.

Denials occur when you submit a bill to an insurance company, for example, and they decline it. They are “denying” your claim for payment.

That’s not the end of a healthy practice’s quest for being paid for that particular visit or procedure, of course. You can resubmit, or if you need to, bill the patient directly.

But Denials are usually issued for some common and preventable reasons:

1. Missing Information

– during our Billing and Coding Audits we see this all the time. Insurance companies will deny a claim because a box isn’t checked or field is left blank.

- No zip code = DENIED

- Missing middle initial = DENIED

- Missing digit on medical code = DENIED

2. Duplicate claims

– this happens more often than you would think. The Coder, or the physician, records the procedure in a way that’s the same, or too similar to a previous procedure the insurer already paid on.

3. Coding issue

- probably the most frequent, and most painful denials are based on improper medical coding. Using the wrong code, outdated code, or duplicate code on a bill.

Medical Coding Issues

#3 above is deceptive. While denials from improper medical coding are simple to fix – you just change the code accordingly and re-file – it can be an indicator of bigger issues.

Because if improper medical coding is getting some claim denied, it’s VERY likely that some improperly coded procedures are making it through.

To your detriment.

Most in-house medical coders and billing clerks are “key it as you see it” coders. Meaning they’re just typing in the code offered.

They’re assuming that the code is CURRENT and Correct every time.

The “Integra Way”, or what we do when you outsource billing and coding to us, requires us to read all of the physician’s notes and comments. We must understand what the procedure was according to all the information. Then we verify it all and submit the claim to the payer.

Knowing what the correct or optimal code is and how to submit that properly to a particular payer drives denials down to almost ZERO and drives practice income UP.

Good Practice Management and 3 Numbers

Pop quiz… what are YOUR 3 numbers?

1. Aging Accounts Receivable?

2. Write Offs?

3. Denials?

If you don’t know – or you DO know and aren’t happy with them – please take advantage of our FREE Practice Audit or FREE Billing-Coding Audit today.

Call (727) 233-2901